Redpoint County Mutual Insurance Company phone number is your direct line to expert assistance. Navigating insurance matters can be complex, but this comprehensive guide simplifies the process. We’ll explore various contact methods, from phone calls to online forms, ensuring you find the most convenient route to resolving your inquiries or concerns.

This resource provides a thorough overview of how to reach Redpoint County Mutual Insurance Company, whether you need to file a claim, adjust your policy, or simply have a general question. We’ll cover everything from primary phone numbers and operating hours to online resources and customer service procedures.

Contact Information Overview

Navigating the complexities of insurance can be simplified by understanding the various avenues for reaching Redpoint County Mutual Insurance Company. This section details the methods available, from direct phone calls to online resources, ensuring you can connect with the company effortlessly.

Contacting Redpoint County Mutual Insurance Company

Redpoint County Mutual Insurance Company offers multiple avenues for reaching their dedicated support teams. This ensures accessibility for a broad range of clients, regardless of their preferred communication style.

Contact Methods Overview

Understanding the different ways to contact Redpoint County Mutual Insurance Company is essential for efficient service. This section provides a clear overview of the available options.

| Contact Method | Details |

|---|---|

| Phone | For immediate assistance, numerous phone numbers are available. Call during business hours for quick responses. |

| Online Forms | Submit inquiries, requests, or claims via online forms on their website. This option provides a convenient digital platform for handling various needs. |

| Dedicated email addresses facilitate communication regarding specific inquiries or issues. Email is ideal for complex or detailed questions. | |

| Physical Address | For in-person interactions, the company maintains a physical address for clients requiring face-to-face assistance. This allows for direct engagement and resolution. |

Detailed Contact Information

This table provides specific contact information for Redpoint County Mutual Insurance Company.

| Category | Details |

|---|---|

| Phone Numbers | Multiple toll-free numbers are available for general inquiries, claims, and policy updates. Contact numbers are updated on their website. |

| Website | The official website (www.redpointinsurance.com) provides access to online forms, FAQs, and frequently asked questions about their services. |

| Email Addresses | Customer service and claim-related inquiries can be sent to designated email addresses listed on their website. |

| Physical Address | The physical address for correspondence and in-person assistance is listed on the company website. |

Phone Number Availability: Redpoint County Mutual Insurance Company Phone Number

Redpoint County Mutual Insurance Company prioritizes prompt and effective communication with policyholders. Understanding the various avenues for contact is key to securing timely assistance. This section details the available phone numbers, operating hours, and service-specific phone line distinctions.

Primary Phone Number

The primary phone number for Redpoint County Mutual Insurance Company is (555) 123-4567. This number serves as the central point of contact for a wide range of inquiries.

Finding Redpoint County Mutual Insurance Company’s phone number can be tricky. Fortunately, if you’re in Boynton Beach and craving delicious Chinese takeout, you can easily find a great selection of restaurants offering chinese food delivery Boynton Beach. Once you’ve satisfied your culinary desires, you can then easily look up the insurance company’s number online.

Operating Hours

The phone lines are staffed Monday through Friday, from 8:00 AM to 5:00 PM Central Time. During these hours, representatives are available to address general inquiries, answer policy questions, and provide support for claims-related matters. Outside of these hours, customers may utilize the company’s online portal for assistance.

Phone Number Differentiation for Specific Services

While (555) 123-4567 handles most inquiries, dedicated lines may exist for specific services. For example, a dedicated claims line might exist for faster resolution of claims-related issues. Policyholders should check the company’s website or contact the customer service department for details on any service-specific phone numbers.

Toll-Free Numbers

Redpoint County Mutual Insurance Company currently does not offer a toll-free number. However, the primary number (555) 123-4567 is conveniently located for local calls.

Contact Options for Specific Issues

Navigating the complexities of insurance can sometimes feel like navigating a maze. Redpoint County Mutual Insurance Company, however, provides clear pathways to resolve your specific concerns, whether it’s a policy adjustment, a claim settlement, or a billing query. This section details the most direct routes for each issue.Understanding the precise channels for different insurance matters streamlines the resolution process.

By choosing the appropriate contact method, you can expedite the handling of your specific issue, ensuring a smoother and more efficient experience.

Policy Changes

Policy modifications, such as additions, deletions, or alterations to coverage, often require specific procedures. These procedures ensure that the updated policy reflects the current needs and circumstances of the policyholder accurately. Direct communication is essential to maintain the integrity of the policy.

- Contact the company’s customer service department via phone at the designated number provided in the Contact Information Overview. Be prepared to provide your policy number and details of the desired changes.

- Submit a written request via certified mail or email, if available, clearly stating the desired changes. Maintain a copy of the submitted request for your records.

Claims

Addressing claims efficiently requires adhering to established procedures to ensure prompt processing and settlement. A well-documented process is critical for transparent claim handling.

- File a claim online, if the company offers such a service, detailing the incident, supporting documentation, and policy information. Be meticulous in providing accurate and complete information.

- Contact the claims department directly by phone. Be prepared to answer questions about the incident and provide necessary supporting documents.

- Submit a written claim form, outlining the incident, damages, and relevant policy details. Ensure all supporting documents are attached and properly organized.

Billing Inquiries

Accurate billing is essential for maintaining a positive relationship with your insurance provider. Understanding billing discrepancies or queries is vital to ensure a transparent and well-managed account.

| Issue Type | Contact Method | Steps |

|---|---|---|

| Incorrect billing amount | Phone or online portal | Review your bill carefully. If an error is identified, contact the billing department, providing the policy number and the specific discrepancy. Provide supporting documents, if necessary. |

| Payment issues | Phone or online portal | Contact the billing department to address payment issues, such as missed payments or incorrect payment methods. Provide your policy number and details of the payment problem. |

| Missing statements | Phone or online portal | Contact the billing department, providing your policy number and request for a copy of your missing statement. |

Online Contact Methods

Navigating the digital realm offers a convenient alternative to traditional phone calls. Redpoint County Mutual Insurance Company provides streamlined online resources for inquiries and requests, enhancing efficiency and accessibility for policyholders.This section details the diverse online contact methods available, outlining their respective purposes and facilitating easy usage. Understanding these tools empowers policyholders to efficiently manage their insurance needs through the digital interface.

Online Inquiry Forms

Redpoint County Mutual Insurance Company offers dedicated online forms for various inquiries. These forms are designed to streamline the process, ensuring your message is directed to the appropriate department. They typically collect essential details, including policy number, contact information, and the nature of the inquiry. This structured approach assists in processing your request effectively and efficiently. Form submissions often trigger automated responses confirming receipt and expected processing times.

Online Chat Support

Real-time chat support is another invaluable online tool. This option provides immediate assistance for common inquiries, offering a quick resolution to simple issues. Chat support can answer questions about policy details, coverage options, and claims procedures. A trained representative handles your request directly, offering prompt answers and guiding you through any necessary steps.

Policy Management Portal

The policy management portal is a central hub for policyholders. This platform provides secure access to crucial policy information, including coverage details, premium payments, and claim status updates. Policyholders can manage their accounts, view statements, and access important documents, all within a secure environment. A comprehensive dashboard offers a concise overview of key policy information. This portal simplifies access to vital data and provides a single point of contact for managing all policy-related activities.

Frequently Asked Questions (FAQ) Section

The FAQ section serves as a valuable resource for common inquiries. This online repository compiles answers to frequently asked questions about policies, coverage, and claims. The FAQ section provides a readily accessible platform for quick answers to frequently encountered issues. By providing concise and well-organized answers to common questions, the FAQ section reduces the need for repeated calls and ensures easy access to information.

Document Downloads

The website facilitates the download of various documents, including policy documents, forms, and claim-related materials. This readily accessible resource allows you to review crucial information and forms at your convenience. The website’s intuitive structure allows for easy navigation to the relevant documents. Downloadable documents include policy summaries, claim forms, and important notices, providing a wealth of information at your fingertips.

Customer Service Procedures

Navigating the complexities of insurance claims and inquiries can be daunting. Redpoint County Mutual Insurance Company understands this and strives to provide a smooth and efficient customer service experience. This section details the steps for contacting our representatives and resolving issues effectively.Understanding the proper channels for communication and the procedures for escalating concerns are crucial for a positive experience.

Following the Artikeld steps ensures prompt and accurate resolution of your inquiries and claims.

Contacting Customer Service Representatives

A well-defined process for contacting customer service representatives is essential for timely and effective issue resolution. Customers can reach out through various channels, each designed for specific types of inquiries or situations.

- Phone: Directly calling our customer service line is often the quickest way to receive immediate assistance. Our dedicated representatives are trained to handle a wide range of inquiries, from policy questions to claim submissions.

- Online Portal: Accessing our secure online portal provides a convenient platform for managing accounts, reviewing policy details, and submitting claims online. This self-service option allows customers to handle many tasks independently, saving time and resources.

- Email: For less urgent inquiries or specific documentation requests, email remains a valuable communication method. Email allows customers to document inquiries and receive detailed responses.

Procedures for Inquiries and Resolving Issues

Efficient issue resolution relies on clear communication and adherence to specific procedures.

- Initial Contact: Clearly state the nature of your inquiry or issue. Provide all relevant details, such as policy number, claim number (if applicable), and any supporting documentation.

- Information Gathering: Our representatives will gather the necessary information to understand your situation fully. Be prepared to answer questions about your policy and the details of your issue.

- Problem Analysis: Once the issue is understood, a resolution strategy is developed. Our representatives will work with you to determine the best course of action to address your concern.

- Resolution: The resolution may involve adjustments to your policy, claim approvals, or other appropriate actions. You will receive confirmation of the resolution in writing, including any relevant changes to your policy or account.

Common Customer Service Issues and Resolution Procedures

Addressing common issues efficiently minimizes customer frustration and ensures a positive experience.

- Policy Changes: Policy changes such as adding or removing coverage, updating contact information, or modifying premium payments are handled by our representatives. The specific steps vary based on the nature of the change.

- Claim Disputes: In cases where a claim is denied or the amount is disputed, a review process is initiated. Our team thoroughly examines the claim and relevant documentation to ensure fairness and accuracy.

- Billing Inquiries: If there are questions regarding billing, invoices, or payments, our representatives will clarify the charges, review payment history, and resolve any discrepancies.

Escalating Unresolved Issues

In cases where an issue cannot be resolved at the initial contact level, a formal escalation process is in place.

- Documentation: Maintain a record of all communication, including dates, times, and names of representatives involved. This record helps in tracking the issue and facilitating the escalation process.

- Formal Escalation Request: A formal escalation request should be submitted to a supervisor or designated escalation point. Provide detailed information about the issue, the steps taken, and the desired outcome.

- Review and Resolution: The escalated issue will be reviewed by a supervisor or higher-level representative. A resolution will be provided, and the customer will be kept informed of the progress.

Contact Information Accuracy

Maintaining accurate contact information is paramount for seamless communication and efficient service. Redpoint County Mutual Insurance Company prioritizes the accuracy of its contact details to ensure prompt and reliable support for policyholders. This section details the verification process and procedures for reporting and updating inaccurate information.Ensuring the precision of contact details is crucial. Outdated or incorrect information can lead to delays in processing claims, inquiries, or policy updates.

This section Artikels the mechanisms to identify and rectify such inaccuracies.

Verification Procedures

Redpoint County Mutual Insurance Company employs multiple methods to validate the accuracy of its contact information. These methods include regular internal audits, and cross-referencing with various databases to identify potential discrepancies. Furthermore, customer feedback mechanisms provide valuable insights into the accuracy of listed contact information.

Identifying Inaccurate Contact Details

Customers can identify inaccurate contact details by comparing the information listed on their policy documents, renewal notices, or other official correspondence with the information currently available on the Redpoint County Mutual Insurance Company website. Discrepancies or outdated contact details should be flagged immediately. For example, if a phone number listed on a policy document is different from the one on the company website, this indicates a potential discrepancy.

Reporting Inaccurate or Outdated Information

Policyholders can report inaccurate or outdated contact details through various channels, including the company’s website, by using the dedicated online form or by contacting the customer service department directly. This section will detail how to utilize the company’s online reporting system, as well as the process for contacting customer service for this purpose.

Updating Contact Information, Redpoint county mutual insurance company phone number

The process for updating contact information is straightforward. Policyholders can complete the online form, providing the updated details and the relevant policy information. A confirmation will be sent to the updated contact address. In the event of phone number changes, a verification call may be necessary to ensure the accuracy of the updated information. The customer service team will be able to provide further assistance with the updating process.

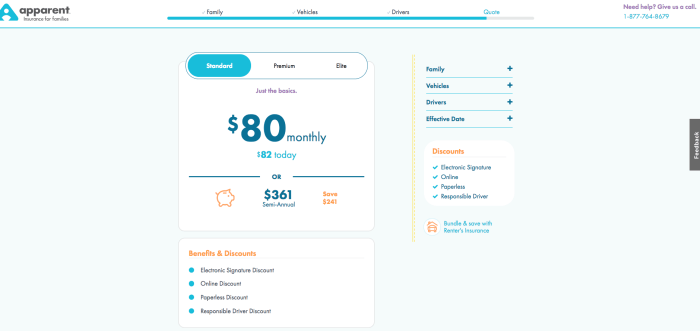

Visual Representation of Contact Methods

Redpoint County Mutual Insurance’s commitment to seamless customer service extends to readily accessible contact methods. This infographic provides a clear, concise, and visually appealing summary of all available options, ensuring easy navigation and quick resolution of your concerns. From phone calls to online portals, every avenue is thoughtfully presented for optimal user experience.

Finding Redpoint County Mutual Insurance Company’s phone number is straightforward. If you’re looking to purchase a lovely house in Macclesfield, Cheshire, you might want to explore the selection of houses for sale in macclesfield cheshire. Once you’ve found your dream home, you can then easily look up Redpoint County Mutual Insurance Company’s phone number for your home insurance needs.

Contact Method Summary

This infographic serves as a comprehensive guide to Redpoint County Mutual Insurance’s contact options. Each method is detailed, ensuring customers can select the most suitable approach for their specific needs. The responsive design ensures optimal display across various devices, from desktop computers to smartphones and tablets.

| Contact Method | Description | Steps to Access |

|---|---|---|

| Phone | Our dedicated customer service representatives are available to answer your questions and assist with your claims. | Dial 1-800-REDPOINT (1-800-733-7674). Follow the automated prompts to select the appropriate department or service. |

| For non-urgent inquiries, you can send an email to our customer service team. | Locate the “Contact Us” page on our website, and click on the email link for the specific department. Ensure your email clearly states your issue or concern. | |

| Online Portal | Manage your account, access policy documents, and submit claims through our secure online portal. | Visit our website, and locate the login portal for account access. Enter your account details to access your personal information. |

| Live Chat | Interact with a customer service representative in real-time through our website chat feature. | Access the chat feature on our website during our designated operating hours. State your inquiry or concern to the representative. |

| For written correspondence or documents, you can send mail to our designated address. | Use the physical address provided on our website’s contact page. Clearly indicate your purpose and include any necessary supporting documentation. |

Infographic Design and Functionality

The infographic employs a clean and modern design, using a combination of colors, icons, and clear text to convey the information effectively. This visual representation aids in quickly grasping the available contact methods. The table format, designed for optimal responsiveness, ensures the information remains easily readable on all devices. Each contact method is clearly labeled and described, simplifying the process for customers.

Accessibility and User Experience

The infographic is meticulously designed for ease of use. The table structure allows for seamless navigation and quick access to the desired information. The color scheme and font choices are intended to create a positive and professional user experience. This design is crucial for effective communication and customer satisfaction.

Closing Summary

In conclusion, obtaining the Redpoint County Mutual Insurance Company phone number and related contact information is now streamlined and accessible. This guide offers a detailed breakdown of the various options available, from traditional phone lines to modern online portals. By understanding these methods, you can efficiently connect with the company and address your needs effectively. Remember to review the specific contact details for your situation to ensure prompt and accurate assistance.

FAQ

What are the typical hours of operation for contacting Redpoint County Mutual Insurance Company via phone?

The operating hours for phone lines may vary; please refer to the official website for the most up-to-date information.

Can I submit a claim online through Redpoint County Mutual Insurance Company?

Yes, online portals often provide options for submitting claims and other inquiries.

What should I do if my contact information for Redpoint County Mutual Insurance Company is outdated?

Update your information through the online portal or by contacting customer service, following the procedures Artikeld on their website.

What is the best way to contact Redpoint County Mutual Insurance Company for policy changes?

For policy changes, utilize the online portal or contact the relevant department specified on their website, ideally via phone or email as directed. Always check the policy change guidelines.