Example of car insurance card, a vital document for every motorist, ensures swift and secure claims processes. This guide delves into the intricacies of these cards, from their essential functions to the security measures employed in their digital and physical forms. Understanding the various types, information contained, and verification procedures empowers drivers to navigate the complexities of insurance effectively.

This comprehensive exploration of car insurance cards unpacks the details, making the process of understanding and utilizing these essential documents straightforward. We’ll examine the nuances of physical and digital formats, shedding light on their respective advantages and disadvantages. The significance of information like policy numbers and vehicle details will be explained, ensuring clarity on the purpose and usage of these crucial documents.

Defining a Car Insurance Card

A car insurance card is a crucial document that acts as proof of your vehicle’s insurance coverage. It’s a physical representation of your policy, and it’s essential for various interactions with authorities and other parties. This card contains vital information that verifies your insurance status, protecting you in case of an accident or other incident.Understanding the details on this card is important for ensuring you are compliant with regulations and maintaining peace of mind while driving.

This document will provide a comprehensive overview of car insurance cards, their purpose, and the critical information they contain.

What a Car Insurance Card Is

A car insurance card is a printed document issued by an insurance company to a policyholder. It provides evidence of valid insurance coverage for a specific vehicle. Its purpose is twofold: to inform other drivers and authorities of the insured’s coverage and to serve as a quick reference for the policyholder. This card is often required in various situations, from handling minor accidents to navigating legal processes.

Information Found on a Car Insurance Card

A car insurance card typically contains essential information about the policyholder and their vehicle’s insurance. This information ensures that all parties involved in an incident, or those interacting with the policyholder, have access to crucial details.

Essential Elements of a Car Insurance Card

This table Artikels the key elements found on a standard car insurance card, highlighting their importance.

Yo, check out this sick example of a car insurance card! It’s super important to have one, right? Plus, living in an apartment has its own perks, like less maintenance hassle and easier access to cool cafes, especially if you’re looking at advantages of living in an apartment. Anyway, you definitely need that insurance card for all the driving adventures! It’s crucial, you know?

| Element Name | Description | Importance |

|---|---|---|

| Policyholder Name and Address | The name and address of the person or entity who holds the insurance policy. | Identifies the policyholder, crucial for verification and correspondence. |

| Vehicle Identification Number (VIN) | A unique alphanumeric code identifying the specific insured vehicle. | Essential for confirming the coverage applies to the correct vehicle. |

| Policy Number | A unique identifier for the insurance policy. | Used to track and locate the specific policy details. |

| Insurance Company Name and Address | The name and address of the insurance company providing the coverage. | Allows for direct communication with the insurer if needed. |

| Policy Effective and Expiration Dates | The dates when the insurance coverage begins and ends. | Confirms the validity of the policy and avoids gaps in coverage. |

| Policy Limits (Liability, Collision, etc.) | The maximum amount the insurance company will pay out for different types of claims. | Defines the financial protection offered by the policy, vital in case of a claim. |

| Contact Information (Phone Number, Email) | The contact information for the insurance company or claims department. | Facilitates communication and reporting for claims or policy inquiries. |

Types of Car Insurance Cards

Car insurance cards are more than just pieces of paper; they’re crucial documents that verify your coverage and protect you on the road. Understanding the various formats available, from physical cards to digital options, empowers you to choose the most convenient and secure method for managing your insurance. Knowing the pros and cons of each type will help you make informed decisions about your car insurance.Different formats of car insurance cards cater to diverse needs and preferences, offering varying degrees of convenience and security.

These options reflect the evolving nature of technology and how people manage their information. Choosing the right format depends on individual priorities and the level of convenience and security desired.

Yo, check out this example of a car insurance card—it’s all about those details, right? Like, if you’re looking to upgrade your digs, you gotta check out mobile homes for sale in Salinas CA, mobile homes for sale in salinas ca. Gotta make sure everything’s legit, you know? So, yeah, keepin’ those car insurance documents in order is important too.

Basically, you need the right papers for everything.

Physical Car Insurance Cards

Physical car insurance cards are the traditional form of insurance documentation. These cards are tangible, printed pieces of paper that contain essential information about your policy, including your policy number, coverage details, and contact information. They’re readily available, readily visible, and can be easily presented when needed.

Digital Car Insurance Cards

Digital car insurance cards are becoming increasingly popular, especially with the proliferation of smartphones. These cards exist as electronic records stored within your insurance company’s online portal, accessible via a mobile application or a dedicated website. They eliminate the need for carrying a physical card, and many modern applications allow you to easily share the necessary information electronically.

Online Insurance Portals

Online portals offer a comprehensive view of your insurance policies, providing access to a wealth of information beyond just the insurance card itself. These platforms often feature detailed policy summaries, claim status updates, and access to digital copies of your insurance documents. This method offers a high degree of accessibility and allows for easy management of your policy details from any device with internet access.

Comparison Table

| Feature | Physical Card | Digital Card | Online Portal |

|---|---|---|---|

| Accessibility | Easily accessible when physically present. | Accessible on your phone, anywhere with a connection. | Accessible from any device with internet access. |

| Security | Generally less susceptible to digital theft. | Security depends on phone security measures, but typically very secure if well-protected. | High security measures usually employed, but depends on the portal’s protection measures. |

| Convenience | Simple and readily available, but can be cumbersome to carry. | Very convenient, eliminating the need for a physical card. | Extremely convenient for managing all aspects of your policy. |

| Cost | Usually low or free. | Usually low or free. | Usually low or free. |

Factors Influencing Choice

Several factors influence the choice of car insurance card format. These factors include the level of security desired, the frequency of travel, the preference for paper-based documentation, the level of digital literacy, and the overall convenience that each option provides. A digital card might be ideal for someone who frequently travels, whereas a physical card might be preferred by someone who prefers a tangible document.

Information on a Car Insurance Card

Your car insurance card isn’t just a piece of paper; it’s a crucial document containing vital information about your policy. Understanding what’s on it and why each piece of data is important empowers you to quickly access your coverage details and potentially resolve any issues efficiently. This comprehensive guide dives into the details, ensuring you’re fully informed about the information found on your car insurance card.This information is essential for verifying your coverage, especially in situations requiring proof of insurance.

Knowing the details on your card can help avoid delays or complications when interacting with authorities or repair shops.

Policy Number

A unique identifier for your specific insurance policy. It’s crucial for locating your policy details quickly and efficiently when contacting your insurance company. Policy numbers often follow a specific format, and variations exist across different insurance providers. Examples include: 2023-ABC1234, or 2024-XYZ5678, or 1234567-ABCDEFG. These numbers are unique to your policy and are used to retrieve specific policy details.

Insured’s Name

The name of the policyholder. This is essential for verifying that the insurance coverage applies to the correct individual. This is also important to confirm that the driver of the vehicle is covered under the policy.

Vehicle Details

Your car insurance card usually lists the vehicle’s details, including the make, model, year, and vehicle identification number (VIN). This allows insurance companies to quickly identify the insured vehicle. This information is crucial for accurate claim processing and verifying that the vehicle is covered under the policy.

Table of Crucial Information

| Information Type | Example | Explanation of Relevance |

|---|---|---|

| Policy Number | 2024-XYZ9876 | Uniquely identifies your policy for quick access to details. |

| Insured’s Name | Jane Doe | Confirms the policyholder’s identity and coverage. |

| Vehicle Details | Toyota Camry, 2022, ABC1234567 | Identifies the insured vehicle and ensures accurate claim processing. |

| Policy Effective Dates | 01/01/2024 – 12/31/2024 | Indicates the period when the policy is active and valid. |

| Insurance Company Name and Address | Acme Insurance, 123 Main St, Anytown, USA | Specifies the insurance provider and contact information. |

Importance and Use Cases of a Car Insurance Card

Your car insurance card isn’t just a piece of paper; it’s your lifeline in case of an accident or claim. It holds crucial information about your policy, allowing you to quickly and efficiently access the necessary support. This document details the critical role your car insurance card plays in various situations.Having a readily accessible car insurance card is paramount to ensuring a smooth claim process.

It acts as your key to navigating the complexities of insurance procedures, enabling you to resolve issues quickly and efficiently. Knowing how to use your card effectively can save you time, stress, and potential complications.

Practical Applications of a Car Insurance Card

The car insurance card isn’t just for emergencies; it serves as a constant reference. Knowing the information it contains helps you manage your policy effectively. From understanding your coverage limits to finding contact details for your insurer, the card is a vital resource.

Situations Where a Car Insurance Card is Essential, Example of car insurance card

Your car insurance card becomes indispensable in numerous situations. From minor fender benders to serious accidents, it provides the necessary details for processing claims swiftly. Knowing how to use it empowers you to manage claims effectively, minimizing potential issues.

Using a Car Insurance Card During an Accident or Claim

In the event of an accident, the car insurance card is your first line of action. It provides the necessary information for the involved parties and authorities, facilitating a smooth and organized claim process. The details on the card will help you and the insurance companies resolve the situation efficiently.

Example Scenarios and Card Usage

Understanding how to use your car insurance card in various scenarios is crucial. The following table demonstrates the practical applications in different situations:

| Scenario | Action | Outcome |

|---|---|---|

| Minor fender bender with another driver | Exchange insurance information, including the card details, with the other driver. | Provides a clear path for claim filing and a speedy resolution. |

| Major accident involving multiple vehicles | Provide the insurance card to the police and other involved parties. | Ensures accurate reporting and facilitates a coordinated claim process, including the involvement of all parties involved. |

| Damage to your car due to a storm | Contact your insurance provider with your card, outlining the damages and providing details. | Provides the necessary information for processing the claim and assessing the extent of the damage, enabling a timely settlement. |

| Third-party property damage | Provide the insurance card to the affected party and their insurance company. | Enables a smooth claim process for all parties involved, ensuring compensation for damages. |

| Need to verify coverage details | Consult your insurance card to check the details of your coverage, like limits and exclusions. | Allows you to accurately understand your policy and avoid potential surprises during a claim. |

Digital vs. Physical Car Insurance Cards

The evolution of technology has profoundly impacted various aspects of our lives, and car insurance cards are no exception. Traditional physical cards are slowly being replaced by their digital counterparts, offering a range of advantages in terms of accessibility, security, and convenience. This shift highlights the ongoing trend of digital transformation across industries.Digital car insurance cards offer a host of benefits that physical cards simply can’t match.

Their accessibility and ease of use make them particularly appealing in today’s fast-paced world. These cards, stored on a smartphone or other digital device, can be instantly accessed, eliminating the need to carry a physical card and reducing the risk of losing or misplacing it.

Benefits of Digital Car Insurance Cards

Digital car insurance cards streamline the claims process and enhance overall convenience. Their accessibility, combined with robust security measures, provides a seamless user experience. Users can easily access their insurance details anytime, anywhere, through their mobile device. This feature proves invaluable during emergencies, allowing drivers to quickly access policy information when required.

Security Measures in Digital Systems

Digital car insurance card systems employ a variety of security measures to protect sensitive data. These measures include encryption, secure servers, and multi-factor authentication. Encryption transforms data into an unreadable format, preventing unauthorized access. Secure servers house the data in protected environments, limiting the risk of breaches. Multi-factor authentication, often involving a combination of passwords and security tokens, adds another layer of security, making it significantly harder for unauthorized individuals to access the information.

Pros and Cons of Physical Car Insurance Cards

Physical car insurance cards have served as the standard for decades. However, the digital age has brought forth a shift in preferences. A physical card provides a tangible proof of insurance, which might be preferred in some situations, but it’s also prone to loss or damage. A digital card offers convenience and accessibility without compromising security.

Convenience and Accessibility Comparison

Digital cards offer unparalleled convenience and accessibility. They are easily accessible from any smartphone or other compatible device, eliminating the need to carry a physical card. This accessibility is particularly beneficial in emergencies, enabling instant access to policy details when required. In contrast, physical cards require physical possession, which can be inconvenient in certain circumstances. Their accessibility is limited to the location of the physical card.

Comparison Table: Digital vs. Physical Car Insurance Cards

| Feature | Digital Card | Physical Card |

|---|---|---|

| Accessibility | Instant access from any device, anytime, anywhere | Limited to physical possession |

| Security | Robust security measures (encryption, multi-factor authentication) | Potentially vulnerable to loss or theft |

| Convenience | Easy to use, quick access to policy information | Requires physical handling |

| Portability | Highly portable, stored electronically | Limited portability |

| Cost | Usually no additional cost compared to physical cards | Minimal cost for the card itself |

Verification and Validation of a Car Insurance Card

Ensuring the authenticity and validity of your car insurance card is crucial. A fraudulent or expired card can lead to significant problems, including penalties and denial of coverage in the event of an accident. This section Artikels methods for verifying the legitimacy of your insurance and validating its information.Knowing how to verify your car insurance card protects you from potential issues and ensures you’re properly covered.

Thorough validation safeguards your rights and responsibilities as a driver.

Authenticating the Insurance Card

Verifying the authenticity of a car insurance card is a vital first step. Look for official logos and seals that indicate the insurer’s legitimacy. These should be readily visible and easily identifiable. Avoid using insurance cards that lack these critical elements.

Validating Information on the Card

Accuracy in the details is paramount. Check the policyholder’s name, address, vehicle details, and policy number against your records. Discrepancies could signal a potential problem. Cross-reference the information on the card with your policy documents to ensure complete accuracy. Matching the policy number and details is crucial to validate the card’s information.

Identifying Potential Fraud

Detecting potential fraud requires vigilance. Be wary of unusual or suspicious details on the insurance card. Look for inconsistencies or discrepancies in the information provided. Unfamiliar or altered information should raise immediate concerns. Unusual or hastily printed cards should also be considered a potential red flag.

Checking Insurance Card Validity

A thorough procedure for checking validity is essential. First, check the expiration date. Ensure the policy hasn’t lapsed or expired. A valid insurance policy is critical. Also, verify the effective dates of coverage.

This ensures you’re covered for the specific period you need. Finally, confirm that the card aligns with your current vehicle registration details. All information should accurately reflect your current policy and vehicle registration.

Detailed Procedure for Checking Insurance Card Validity

- Review the Expiration Date: Carefully examine the expiration date printed on the card. A lapsed policy is ineffective.

- Confirm Coverage Dates: Check the effective dates on the card. These dates specify the period of coverage.

- Verify Vehicle Details: Ensure the vehicle details on the card match your current vehicle registration.

- Cross-Reference with Policy Documents: Compare the information on the card with your official policy documents to confirm accuracy.

- Examine for Irregularities: Look for unusual printing, inconsistencies, or altered information that could suggest fraud.

Illustrative Examples of Car Insurance Cards

Car insurance cards are more than just pieces of paper; they’re your proof of protection on the road. They hold vital information about your coverage, allowing for quick verification and smooth claims processing. Understanding the various formats and visual elements on these cards is key to navigating the insurance landscape confidently.The design of a car insurance card often reflects the insurance company’s brand identity and the level of protection offered.

Different insurance companies adopt varying approaches to visual representation, making it important to comprehend the elements to ensure you’re covered properly.

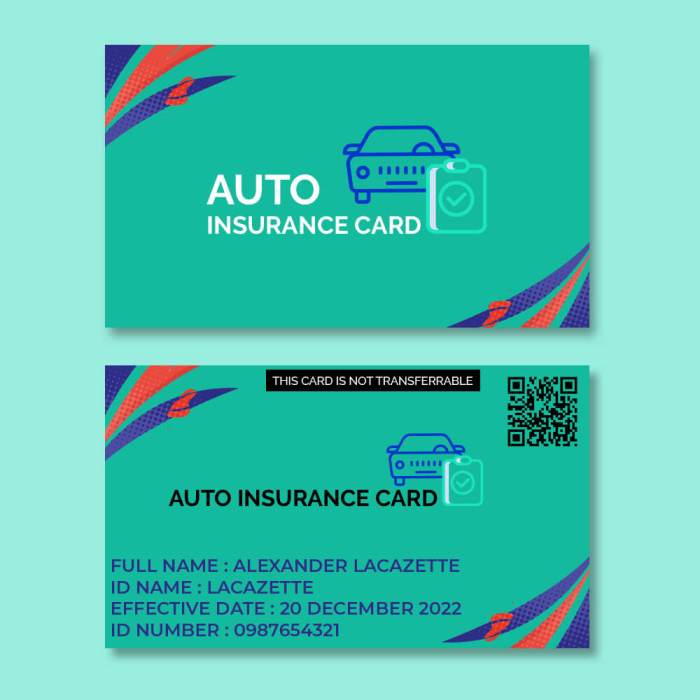

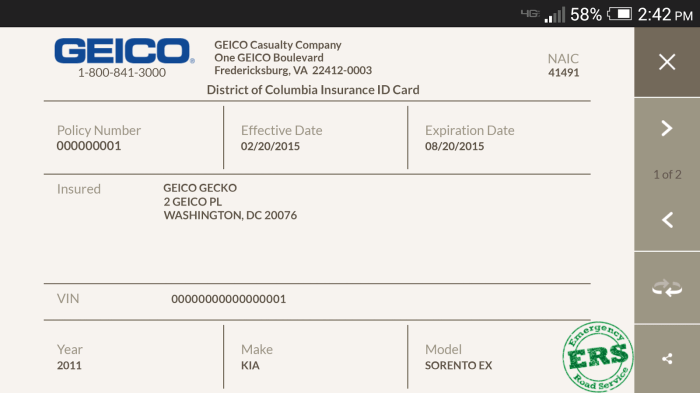

Sample Car Insurance Card Design 1

This example highlights a straightforward, easily readable design. The card features a clear, bold header displaying the insurance company’s name and logo. Essential details, such as policy number, insured vehicle information (make, model, VIN), and policyholder’s name and address, are prominently displayed in a structured format. A secondary section details coverage types, premiums, and expiry date. The card uses a predominantly neutral color scheme to enhance readability and professionalism.

Key visual elements include: a company logo, a policy number prominently displayed, a clear separation of information into sections, and a concise summary of coverage.

Sample Car Insurance Card Design 2

This example emphasizes visual clarity through a more modern and visually appealing design. The card employs a color-coded system to categorize information, making it easier for the policyholder to quickly identify key details. For instance, coverage types are highlighted with different colors, while crucial dates (policy start and expiry) are formatted in bold fonts. Visual cues, like icons or infographics, are used to visually represent different coverage components.

The design often includes a QR code or a barcode for digital access to the policy details. Key visual elements include: a vibrant color scheme for better categorization, infographics and icons for quick identification of coverage components, and a digital access option.

Sample Car Insurance Card Design 3

This design demonstrates a compact format, useful for individuals who want a card that fits easily in their wallet. The card is designed with a clean, minimalist approach. Key details are presented in a condensed format, emphasizing quick access to the most critical information. Essential information, including the policy number, insured vehicle details, and contact information, is presented in a highly organized manner.

The design prioritizes efficiency and ease of carrying. Key visual elements include: a highly organized format to present key information, a minimalist design for easy portability, and clear fonts for quick readability.

Variations in Design Elements

| Design Element | Significance |

|---|---|

| Company Logo | Identifies the insurance provider |

| Policy Number | Unique identifier for the policy |

| Vehicle Details | Specifies the insured vehicle (make, model, VIN) |

| Policyholder Information | Details about the policyholder (name, address, contact) |

| Coverage Types | Artikels the types of coverage included in the policy |

| Premium Information | Displays the premium amount and payment schedule |

| Expiry Date | Indicates the validity period of the policy |

| Contact Information | Provides details for contacting the insurance company |

Different design elements contribute to the overall functionality and usability of the car insurance card. The layout, font size, and color choices directly impact how easily the policyholder can understand and utilize the information on the card.

Final Conclusion: Example Of Car Insurance Card

In conclusion, an example of a car insurance card serves as a critical link between a motorist and their insurance provider, facilitating claims and safeguarding their rights. The journey through this guide provides a thorough understanding of the diverse facets of these cards, empowering individuals to make informed decisions. This detailed overview covers everything from defining the card’s purpose to verifying its authenticity, ensuring a clear and comprehensive understanding for all.

Key Questions Answered

What is the role of a car insurance card during an accident?

A car insurance card is crucial during an accident. It provides immediate access to critical information about your insurance policy, enabling swift and efficient claims processing.

How can I verify the authenticity of a digital car insurance card?

Digital cards often utilize security measures like unique codes and encryption, enabling verification through specific methods provided by the insurance company.

What information should I look for when choosing a car insurance card?

Consider factors like ease of access, clarity of information, and security measures when selecting a card. Ensure the card clearly displays all necessary policy details.

What are the common mistakes to avoid when using a car insurance card?

Avoid misplacing the card or failing to provide the correct details when required. Always ensure the card’s validity before presenting it to claim assistance.