Examples of insurance appeal letters sets the stage for navigating the often-complex world of insurance claims disputes. This guide provides practical insights into crafting compelling arguments for appeal, covering various scenarios and common denial reasons. Learn to structure your letter for maximum impact and avoid common pitfalls.

Understanding the nuances of insurance policy appeals is crucial. This comprehensive resource walks you through the steps of constructing a strong appeal letter, from identifying the specific reason for denial to presenting persuasive evidence and addressing potential counterarguments. Each example showcases different approaches to successfully advocating for your claim.

Introduction to Insurance Appeal Letters

An insurance appeal letter is a formal document used to contest a decision made by an insurance company regarding a claim. Essentially, it’s a persuasive argument presented to the insurance company, highlighting reasons why their initial decision should be reconsidered. This isn’t just a complaint; it’s a strategic effort to re-evaluate the claim based on new information or overlooked aspects.The core purpose of an appeal letter is to present a compelling case for the claim’s validity.

This involves demonstrating the merits of the claim and the potential errors or omissions in the initial denial. A successful appeal letter aims to persuade the insurance company to review its decision and potentially approve the claim. It’s crucial to be organized, clear, and concise to ensure the message is received and understood.

Purpose and Objectives

The primary objective of an insurance appeal letter is to overturn an initial claim denial. Secondary objectives include presenting additional information, explaining misunderstandings, and addressing any perceived deficiencies in the original claim. A strong appeal letter clearly articulates why the initial decision was flawed and why the claim should be approved. By demonstrating the validity of the claim, you increase your chances of success.

Importance of Clarity and Conciseness

Clarity and conciseness are paramount in an insurance appeal letter. Ambiguity or lengthy explanations can dilute the impact of your argument. Insurance adjusters are busy; a well-structured, concise letter gets to the point quickly. Precise language avoids misinterpretations and ensures the core message is readily understood.

Typical Components of a Successful Insurance Appeal Letter

A successful insurance appeal letter typically includes several key components:

- Claim details: Clearly state the claim number, the date of the incident, and a brief summary of the event that led to the claim.

- Original denial explanation: Summarize the insurance company’s initial denial, highlighting any points of contention or perceived errors.

- Supporting evidence: Provide any new evidence, documentation, or details that support your claim. This could include medical records, repair estimates, police reports, or witness statements. Include copies of relevant documents, ensuring they’re organized and easy to follow.

- Argument for reconsideration: Articulate a compelling argument for why the initial decision was flawed. Highlight specific reasons for the claim’s validity. This is where you present the case for your side. Focus on evidence and logic.

- Contact Information: Include your name, address, phone number, and email address.

- Closing statement: A polite and professional closing that summarizes the appeal and restates your request for reconsideration. Be clear and respectful.

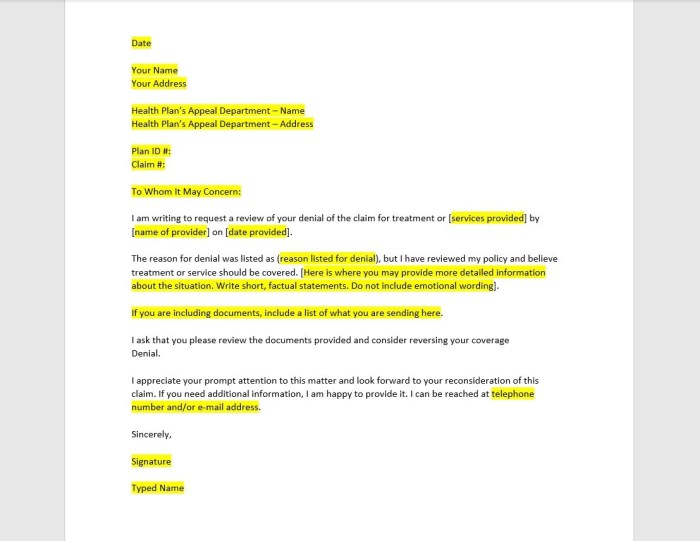

Basic Template for an Insurance Appeal Letter

| Section | Content |

|---|---|

| Heading | Your Name Your Address Your Phone Number Your Email Address Date |

| Subject Line | Insurance Claim Appeal – Claim Number [Claim Number] |

| Introduction | Briefly state the purpose of the letter (appealing a denial). |

| Detailed Description | Provide a clear and concise explanation of the claim and the insurance company’s initial denial. Include the date of the incident, policy details, and the specifics of the claim. |

| Supporting Evidence | Include copies of all supporting documents (medical bills, repair estimates, etc.). Clearly label each document. |

| Argument for Reconsideration | Present a compelling argument for why the claim should be reconsidered. Explain any errors or omissions in the initial denial. |

| Conclusion | Reiterate your request for reconsideration and state your desired outcome. |

| Closing | Sincerely, Your Name |

Types of Insurance Appeals

Insurance appeals aren’t just for the dramatic courtroom scenes; they’re a vital part of the claims process. Understanding the different types of claims that might need an appeal, the common reasons for denial, and the grounds for challenging those denials is crucial for anyone involved in the insurance game.

Knowing these aspects empowers you to navigate the process effectively and increases your chances of a favorable outcome.Insurance companies have established processes for reviewing claims. When a claim is denied, it often means the insurer believes the claim doesn’t meet the policy’s terms or coverage conditions. An appeal gives the policyholder a chance to demonstrate why their claim should be considered valid.

Different Types of Insurance Claims Requiring Appeals

A wide range of insurance policies can lead to appeals. These appeals aren’t just about property damage. They cover various situations, from health insurance to auto insurance and life insurance. Health insurance appeals frequently arise when pre-existing conditions are involved or when coverage for specific treatments is contested. Auto insurance appeals might occur if the insurer disputes liability or the extent of damages.

Life insurance appeals can arise when the insurer questions the validity of the claim, especially if there are suspicions of fraud or misrepresentation.

Reasons for Insurance Claim Denials

Insurance companies have established criteria for claims approval. When a claim is denied, it’s often due to a lack of sufficient evidence, misrepresentation of facts, or failure to meet policy conditions. A common reason for denial is insufficient documentation. Claims may also be denied if the insured event isn’t covered under the policy’s terms. Fraudulent claims, where the insured intentionally misrepresents facts, are another key reason for denials.

Additionally, the insurer might deny a claim if it exceeds the policy’s limits or if the insured party is not the proper claimant.

Specific Issues Leading to Appeals

Several issues often trigger appeals. These issues highlight the complexities within the claims process. One key issue is the interpretation of policy language. Different policyholders might have different interpretations of the policy terms, and this can lead to disagreements. A lack of clear documentation, such as medical records or repair estimates, can also cause issues.

In cases of injuries, establishing the direct causal link between the event and the injury can be challenging and may lead to a denial. Another issue that often leads to appeal is the insurer’s determination of the amount of the claim. Insurers often assess damages based on their own standards and criteria, and these standards might differ from those of the policyholder, creating an area of potential disagreement.

Common Grounds for Challenging a Denial

Policyholders can challenge a denial on various grounds. The policy’s terms and conditions are a major factor. Policyholders can argue that the event falls under the policy’s coverage. Another common ground is the adequacy of the evidence provided. If the policyholder feels the insurer hasn’t considered all relevant documentation, they can argue for its inclusion in the review.

Finally, misrepresentation or fraud allegations, if present, can be addressed.

Comparison of Appeal Processes for Different Policies

The appeal process can vary significantly depending on the type of insurance policy. For example, health insurance appeals often involve more complex documentation and specific procedures Artikeld by regulatory bodies. Auto insurance appeals, while less complex in documentation, can still involve determining liability. Life insurance appeals, due to their sensitivity and the potential for disputes, often require thorough legal review.

Key Elements of a Strong Appeal Letter

Crafting a persuasive insurance appeal letter is crucial for securing a favorable outcome. It’s not just about stating your case; it’s about presenting a compelling argument backed by evidence and a respectful tone. A well-structured letter demonstrates your understanding of the situation and your desire for a fair resolution.

Compelling Introduction

A strong introduction immediately grabs the reader’s attention and sets the stage for your appeal. It should clearly identify the claim number, policyholder name, and the specific policy involved. This concise, accurate introduction establishes the context and ensures the reader is quickly oriented to the matter at hand. A good introduction demonstrates a clear understanding of the claim and avoids ambiguity.

For example, “This letter appeals the denial of claim number 1234567 for policyholder John Smith, under policy XYZ-123, for the accidental damage to the insured property…”

Claim Background Presentation

Thoroughly outlining the claim’s background provides context for your appeal. This involves detailing the circumstances surrounding the event, including the date, time, location, and any relevant supporting evidence. Precise descriptions of the event and its impact on the insured are crucial. For example, if appealing a property damage claim, meticulously describe the damage, any accompanying documentation (photos, reports), and the steps taken to mitigate further damage.

Clear Statement of Reasons for Appeal

Clearly articulating the reasons for appeal is essential. This section should explicitly state why the original decision is incorrect or unfair, referencing specific policy clauses or provisions. It’s important to focus on the specific points of disagreement and avoid generalizations. For example, “The insurer’s decision to deny coverage for the accidental damage is based on a misinterpretation of the policy’s definition of ‘accidental’ as stated in section 2.3.

The incident clearly met the definition…”

Supporting Evidence and Documentation

Supporting evidence is critical for strengthening your appeal. This includes all relevant documentation, such as police reports, medical records, repair estimates, witness statements, and photographs. This evidence should be meticulously organized and referenced in your letter, allowing the insurer to easily locate and review the necessary materials. Present these documents in a logical order to help the reader understand the claim’s history and the justification for your appeal.

Persuasive Presentation of Supporting Evidence

Present supporting evidence in a compelling manner, explaining how each piece of evidence supports your claim. Avoid simply listing documents; instead, explain the significance of each piece and how it directly relates to the reasons for your appeal. For example, “The attached photographs clearly demonstrate the extent of the water damage to the property, corroborating the repair estimates and supporting the claim of water intrusion as the cause of the damage.”

Addressing Counterarguments

Anticipate potential counterarguments from the insurer and address them proactively. If you anticipate a specific reason for denial, preemptively address it with supporting evidence. This demonstrates a thorough understanding of the claim and its potential challenges. For example, “The insurer may argue that the damage was pre-existing. However, the attached inspection report from [date] clearly states the condition of the property before the incident, confirming that the damage was not pre-existing.”

Respectful and Professional Tone

Maintaining a respectful and professional tone throughout the letter is crucial. Avoid accusatory language or aggressive statements. Instead, focus on presenting your case objectively and respectfully. This approach builds credibility and enhances the likelihood of a favorable outcome.

Effective Closing Statements

A strong closing restates your appeal and summarizes the key points. It should reiterate the specific issues you’re addressing and request a specific action, such as a reconsideration of the claim. This section should also reiterate the desired outcome and the supporting documentation included. For example, “In conclusion, we respectfully request a reconsideration of the claim denial.

The provided evidence clearly demonstrates the validity of the claim. We look forward to a prompt response and resolution to this matter.”

Common Mistakes to Avoid

Crafting a compelling insurance appeal letter requires more than just expressing your frustration. It demands a strategic approach that directly addresses the specific policy guidelines and the insurer’s rationale for denial. Failing to understand these nuances can lead to your appeal being rejected. Let’s delve into the pitfalls to avoid.

Emotional Appeals

Emotional appeals, while understandable in the face of a claim denial, often fall flat. Insurance companies are trained to assess claims objectively, based on policy wording and evidence presented. Venting about your hardship, while understandable, doesn’t inherently strengthen your argument. Instead, focus on presenting factual information that aligns with the policy terms and conditions. A well-structured argument based on verifiable data is much more persuasive than a heartfelt plea.

Vague or Ambiguous Language

Vagueness and ambiguity can undermine the clarity of your appeal. Avoid terms that can be interpreted in multiple ways. Be specific and precise in your descriptions of the incident, the damages, and the supporting documentation. If your claim involves medical expenses, for example, provide precise diagnosis codes and treatment details. Clear and concise language will help the insurer understand your case accurately.

Poor Argumentation Techniques

Using poor argumentation techniques can significantly weaken your appeal. One common mistake is failing to address the insurer’s specific reasons for denial. Instead of attacking the insurer’s decision, focus on refuting their rationale with evidence and supporting documentation. A well-structured argument that addresses the specific concerns raised by the insurer will greatly improve your chances of success.

Another pitfall is presenting contradictory information or using irrelevant details.

A whisper of a letter, a plea to the insurance gods, these appeal letters are like tiny, ticklish secrets. They dance with the delicate art of persuasion, hoping to sway a decision. Consider the homes for sale in Big Stone Gap, VA; big stone gap va homes for sale often have intricate histories, tales hidden beneath the shingles, just as these letters conceal a homeowner’s desperate hope.

Each one, a silent plea, a tiny tremor in the vast machinery of insurance claims. These examples are a cryptic study in how to fight back, to challenge the unseen forces that control the flow of compensation.

Grammatical Errors

Grammatical errors can create a negative impression, even if your arguments are sound. A professional tone is essential in an insurance appeal letter. Ensure your letter is meticulously reviewed for any grammatical or spelling errors before submitting it. A polished letter demonstrates respect for the insurance company and increases the likelihood of a positive response.

Non-Adherence to Policy Guidelines

Insurance policies have specific guidelines for submitting appeals. Failing to adhere to these guidelines can lead to your appeal being rejected outright. Carefully review the policy’s provisions related to appeals, including deadlines, required documentation, and contact information. Adhering to these guidelines is crucial to avoid unnecessary delays or rejection.

Lack of Precise and Factual Language

Precise and factual language is vital for a strong appeal. Avoid generalizations and use specific details to support your claim. Provide precise dates, amounts, and verifiable evidence. For instance, if you’re claiming damages to your property, provide detailed photos, repair estimates, and police reports. Using precise language avoids ambiguity and strengthens your case.

Exceeding the Letter’s Length

Maintaining the prescribed length of the appeal letter is essential. Insurance companies often have specific word limits or page restrictions. Exceeding these limits can lead to your letter being overlooked or summarily dismissed. Focus on conveying your arguments concisely and effectively within the designated space. Conciseness is key to ensuring your letter is thoroughly read and considered.

Addressing Specific Denials

Insurance appeals aren’t just about arguing; they’re about presenting a clear, compelling case based on the policy’s specifics and the facts of your situation. Understanding the reasons behind a denial is crucial to crafting a persuasive appeal. Knowing how to effectively address the specific denial reason, demonstrate policy understanding, and counter any company arguments will significantly improve your chances of success.A well-structured appeal letter demonstrates a deep understanding of your claim and the insurance company’s perspective.

This means meticulously reviewing the denial letter, identifying the precise reasons for the rejection, and crafting a targeted response.

Common Denial Reasons and Appeal Strategies

Insurance companies use various criteria to deny claims. Understanding these reasons and how to address them is essential for a successful appeal.

| Denial Reason | Explanation of the Denial | Suggested Appeal Points | Supporting Evidence Examples |

|---|---|---|---|

| Pre-existing Condition | The claim is denied because the condition existed before the policy’s effective date. | Highlight that the condition’s severity wasn’t a factor in daily life and didn’t impact the policy decision. Provide medical records demonstrating a pre-existing condition but showing the condition did not require significant intervention before policy start date. | Medical records, doctor’s letters confirming pre-existing condition was stable prior to policy date, and daily activity records showing no impact on daily life before policy start date. |

| Lack of Necessary Documentation | The claim is denied due to missing or insufficient supporting documents. | Thoroughly review the required documents. Submit all necessary paperwork, including doctor’s notes, receipts, and other supporting evidence. Ensure all documentation is complete, legible, and meets the insurer’s specific requirements. | Complete and accurate copies of medical bills, receipts for treatment, and a detailed explanation letter of the missing documents. |

| Claim Not Covered by Policy | The policy doesn’t cover the specific treatment, procedure, or expense. | Carefully examine the policy’s exclusions and definitions. Highlight the specific policy language supporting your claim. If possible, provide a policy excerpt clearly showing coverage for the situation. | Policy document excerpts, medical records supporting the procedure falls under the coverage definition, and expert witness statements confirming the policy’s coverage. |

| Failure to Meet Policy Requirements | The claimant failed to meet specific policy requirements (e.g., timely filing, required pre-authorization). | Explain why the requirements weren’t met and any extenuating circumstances. Provide evidence of attempts to meet requirements, such as a record of phone calls or emails. If applicable, request a waiver of the policy requirement. | Copies of emails, phone records, letters of communication with insurance company about policy requirement, and any relevant medical records. |

Addressing Specific Denial Reasons in Detail

Addressing each denial reason requires a tailored approach. For instance, if the denial cites a pre-existing condition, your appeal needs to clearly demonstrate that the condition wasn’t a significant factor in the need for the claimed treatment. Provide medical records showing the condition was stable before the policy’s effective date.

Demonstrating Policy Understanding

Directly quoting policy language showing the coverage for the claimed event is essential. Your appeal should explicitly reference the relevant policy sections. Understanding the policy’s terms and conditions and providing relevant policy excerpts is crucial for a strong appeal.

Refuting Counterarguments

Carefully review the insurance company’s counterarguments. Present evidence contradicting their assertions. If the company argues the claim isn’t covered, present evidence showing the treatment or expense is covered. Provide supporting evidence and a concise, well-reasoned rebuttal to the company’s claims.

Showcasing Claim Validity

Provide comprehensive evidence to demonstrate the legitimacy of your claim. This might involve medical records, receipts, and expert testimony. Present a compelling narrative, demonstrating the connection between your situation and the coverage Artikeld in the policy. Comprehensive evidence showcasing the validity of your claim strengthens your appeal.

Example Appeal Letters

Insurance appeals can be tricky, but a well-written letter significantly increases your chances of success. Knowing how to present your case clearly and persuasively is key. This section provides sample appeal letters for different scenarios, demonstrating the structure and content required for effective communication.

Different Appeal Scenarios, Examples of insurance appeal letters

To effectively address various situations, we’ll examine three distinct appeal letter examples. Each example targets a different type of insurance claim denial and highlights crucial components of a successful appeal.

Example Letter 1: Denial of a Claim for a Home Fire

>Subject: Appeal of Claim Denial – Policy Number [Policy Number]

Home Fire on [Date]

>Dear [Insurance Company Name] Claims Department,>This letter appeals the denial of my home fire claim, Policy Number [Policy Number], dated [Date]. My home sustained significant damage in a fire on [Date]. The damage assessment report, attached as Appendix A, clearly Artikels the extent of the damage and the associated costs. The report, prepared by [Name of Assessment Company] and detailed in the attached documentation, estimates the total repair costs at [Amount].

My insurance policy clearly covers damages from fire, as per Section [Section Number] of the policy.>I have provided all necessary documentation requested during the initial claim process. The reason for denial, as stated in your letter of [Date], is [Reason for Denial]. This reason appears to be misconstrued, as the damage assessment is clearly presented in the attached report.>I respectfully request a reconsideration of my claim.

I am confident that, upon reviewing the supporting documentation, you will reverse the denial. I am available to discuss this further at your convenience.>Sincerely,>[Your Name]>[Your Contact Information]

Example Letter 2: Denial of a Claim for a Car Accident

>Subject: Appeal of Claim Denial – Policy Number [Policy Number]

Car Accident on [Date]

>Dear [Insurance Company Name] Claims Department,>This letter appeals the denial of my car accident claim, Policy Number [Policy Number], stemming from the accident on [Date]. The accident report, attached as Appendix A, details the circumstances of the incident and confirms [Details of the accident, e.g., other driver’s fault]. The repair estimates, from [Repair Shop Name], total [Amount], as documented in Appendix B.

My policy clearly covers accidents where the other driver is at fault, per Section [Section Number].>The denial letter states [Reason for Denial]. This reason is not supported by the evidence provided, as the accident report and repair estimates clearly show the damages resulted from the accident and are within the coverage. I am confident that a review of the evidence will result in a favorable outcome.>I request a prompt review of my claim and a reinstatement of my claim.

I am available to discuss this further at your convenience.>Sincerely,>[Your Name]>[Your Contact Information]

Example Letter 3: Denial of a Claim for Medical Expenses

>Subject: Appeal of Claim Denial – Policy Number [Policy Number]

Medical Expenses for [Condition]

>Dear [Insurance Company Name] Claims Department,>This letter appeals the denial of my medical claim, Policy Number [Policy Number], for medical expenses incurred due to [Condition]. The medical bills, totaling [Amount], are attached as Appendix A. These bills, from [Hospital Name], are for treatments directly related to the condition. My policy covers medical expenses resulting from [Condition], as detailed in Section [Section Number].>The denial letter states [Reason for Denial].

A shiver ran through the files, whispers of denied claims echoing in the hushed corridors of insurance appeals. Each letter, a carefully crafted plea, a silent dance with the unknown. Perhaps, just perhaps, a solution lay in the peculiar world of fish-based dog food for allergies, a surprising discovery that hinted at a hidden pattern in the appeals process.

The very essence of the appeal, a delicate balance between logic and the inexplicable, seemed mirrored in the intricacies of this unusual dietary choice. More examples of insurance appeal letters emerged, now subtly tinged with a new, fishy aura.

However, the medical records clearly demonstrate the necessity of the treatments. Furthermore, the medical professional’s report, attached as Appendix B, substantiates the need for the treatments.>I respectfully request a reconsideration of my claim, based on the supporting documentation. I am confident that, upon reviewing the medical documentation, you will reverse the denial. I am available to discuss this further at your convenience.>Sincerely,>[Your Name]>[Your Contact Information]

Comparison of Appeal Letters

| Scenario | Letter 1 (Home Fire) | Letter 2 (Car Accident) | Letter 3 (Medical Expenses) |

|---|---|---|---|

| Home Fire Claim Denial | Focuses on damage assessment report and policy coverage. | Highlights accident report and repair estimates, emphasizing the other driver’s fault. | Emphasizes medical bills and necessity of treatments, referencing policy coverage. |

| Supporting Evidence | Damage assessment report, policy section, and detailed costs. | Accident report, repair estimates, and policy section. | Medical bills, medical professional’s report, and policy section. |

Tips for Effective Communication

Crafting a compelling insurance appeal letter is more than just stating your case; it’s about effectively communicating your needs and rationale to the insurance company. Clear, concise, and professional communication significantly increases your chances of a favorable outcome. Understanding the nuances of communication will greatly enhance your appeal’s impact.

Actionable Tips for Crafting Compelling Appeal Letters

Effective appeal letters are meticulously crafted documents. Each word choice, sentence structure, and paragraph organization contributes to the overall impact. Following these tips will elevate your letter’s persuasiveness:

- Be specific and concise. Avoid vague language and unnecessary details. Focus on the key facts and supporting documentation that directly address the denial. Provide specific reasons for the appeal and back them up with concrete evidence. For example, instead of “the claim was unfairly denied,” state “the claim was denied due to insufficient medical documentation.

However, the supporting records provided include [list specific records] which demonstrate the severity of the injury and its connection to the incident.”

- Use clear and precise language. Avoid jargon or technical terms that the insurance adjuster might not understand. Use simple, straightforward language to ensure your message is easily grasped.

- Organize your thoughts logically. Present your arguments in a structured manner, with clear transitions between points. This will make it easier for the reader to follow your reasoning and understand your position.

- Proofread meticulously. Typos, grammatical errors, and inconsistencies can undermine your credibility. A polished letter shows professionalism and attention to detail, which is crucial for a successful appeal.

Maintaining a Professional Demeanor

Maintaining a professional tone throughout the appeal letter is paramount. This demonstrates respect for the insurance company’s process and increases the likelihood of a positive response.

- Adopt a courteous and respectful tone. Avoid accusatory language or inflammatory statements. Frame your arguments in a constructive and collaborative manner. Even if you disagree with the decision, maintain a professional and respectful approach. For example, instead of “You clearly made a mistake,” use “The denial appears to be based on [reason], but the following evidence suggests otherwise.”

- Focus on the facts. Support your claims with objective evidence and documentation. Avoid emotional appeals or personal anecdotes, unless they directly relate to the facts of the case. Focus on providing verifiable details to substantiate your appeal.

- Use formal business letter format. This shows professionalism and ensures your letter is presented in a standard, easily understood manner.

Following Up After Submitting the Appeal

Following up appropriately can keep your appeal on the insurance company’s radar.

- Send a polite follow-up email or letter after a reasonable period (e.g., 3-4 weeks), unless the company provides an expected timeframe. This demonstrates your continued interest and commitment to resolving the issue.

- Note the date and time of submission in your records. This helps track the process and identify any potential delays.

Handling Potential Delays

Delays in processing insurance appeals can be frustrating. However, proactive strategies can help mitigate the negative impact.

- If you anticipate delays, politely inquire about the status of your appeal. Communicate with the insurance adjuster or claims department to understand the timeline for processing your appeal. If there are delays, follow up with the insurance company in a timely manner.

- Document all communications with the insurance company. This will help keep track of the progress of your appeal and ensure that you have all necessary information on hand.

Ensuring the Appeal Letter is Well-Received

Ensure the appeal letter is well-received by ensuring it aligns with the insurance company’s expectations.

- Familiarize yourself with the insurance company’s appeal procedures. Understanding their specific guidelines will ensure your letter is formatted correctly and meets their expectations. This includes reviewing their website, policy documents, or contacting their customer service department for detailed guidelines.

- Adhere to the specified format for insurance appeals. If the company provides a particular format, be sure to follow it exactly. Use the right address, include necessary details, and follow any other instructions carefully.

Last Point: Examples Of Insurance Appeal Letters

In conclusion, crafting a successful insurance appeal letter requires meticulous preparation and a strategic approach. By understanding the process, common mistakes, and specific denial reasons, you can significantly improve your chances of a positive outcome. Remember to present your case clearly, concisely, and with supporting evidence. The provided examples offer a practical framework for constructing effective appeal letters tailored to diverse situations.

Quick FAQs

What is the typical length of an insurance appeal letter?

There’s no set length, but aim for conciseness and clarity. Focus on presenting the key arguments and supporting evidence efficiently.

What if I’m unsure about the specific policy language?

Carefully review your policy. If necessary, seek clarification from the insurance company directly before writing your appeal.

How can I ensure my appeal letter is well-received?

Maintain a professional and respectful tone throughout the letter. Proofread carefully for any grammatical errors or inconsistencies.

Can I appeal a denial even if the claim is time-sensitive?

Yes, but timeliness is crucial. Familiarize yourself with the appeal deadlines Artikeld in your policy and act promptly.